How Does a Limited Liability Company Loan Work?

A limited liability company (LLC) is a popular business structure that offers many benefits to entrepreneurs. One of these benefits is the ability to borrow money through an LLC loan. In this article, we will explore how a limited liability company loan works and what entrepreneurs need to know before applying for one.

What is an LLC Loan?

An LLC loan is a type of business loan that is specifically designed for limited liability companies. It can be used for a variety of purposes, such as starting or expanding a business, purchasing equipment, or financing inventory. LLC loans are typically offered by banks, credit unions, and other financial institutions.

How Does an LLC Loan Work?

An LLC loan works similarly to other types of business loans. The borrower applies for the loan and provides the lender with information about their business, including financial statements, tax returns, and other relevant documents. The lender then evaluates the borrower's creditworthiness and determines whether to approve the loan.

If the loan is approved, the borrower will receive the funds and will be required to make regular payments to repay the loan. The terms of the loan will vary depending on the lender and the borrower's creditworthiness. Typically, LLC loans have lower interest rates than other types of business loans because they are secured by the assets of the LLC.

What Are the Benefits of an LLC Loan?

There are several benefits to borrowing money through an LLC loan. One of the main benefits is that it allows entrepreneurs to finance their businesses without putting their personal assets at risk. Because an LLC is a separate legal entity from its owners, its assets are protected from creditors in the event of a lawsuit or bankruptcy.

Another benefit of an LLC loan is that it can help entrepreneurs build their credit history. By making regular payments on an LLC loan, entrepreneurs can establish a positive credit history for their business, which can make it easier to obtain financing in the future.

What Are the Risks of an LLC Loan?

While there are many benefits to borrowing money through an LLC loan, there are also some risks that entrepreneurs need to be aware of. One of the main risks is that if the business fails, the borrower may still be personally liable for the loan. This is because lenders may require a personal guarantee from the LLC's owners in order to approve the loan.

Another risk of an LLC loan is that it can be difficult to obtain if the borrower has poor credit or a limited credit history. Lenders may require more collateral or charge higher interest rates if they perceive the borrower as being a higher risk.

Conclusion

In conclusion, an LLC loan can be a valuable tool for entrepreneurs who need financing for their businesses. It offers many benefits, such as protecting personal assets and building credit history. However, it also comes with some risks that entrepreneurs need to be aware of before applying for one. By understanding how an LLC loan works and weighing the pros and cons, entrepreneurs can make informed decisions about whether this type of financing is right for their businesses.

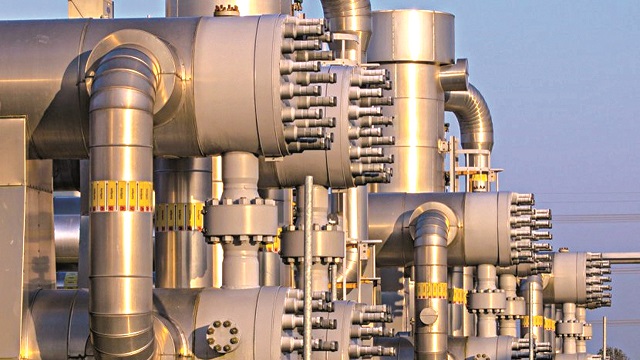

Axxela: Pioneering the Natural Gas Revolution in Nigerian Industries

Axxela, a leading energy company, is spearheading a transformative shift in Nigerian industries through its focus on natural gas. This strategic move aligns with the global trend towards cleaner and more efficient energy sources.Axxela, through its four subsidiaries, supplies natural gas to commerci

The Power of Nigeria’s Young Workforce: A Catalyst for Wealth Creation

TranscriptNigeria’s economy bounced back from its COVID-19 slump with growth of 3.4 percent in 2021. Zenith Bank group managing director Ebenezer Onyeagwu joins World Finance to discuss the country’s ...

Baiduri Bank: Pioneering the Future of Sustainable Banking

In an era where sustainability is no longer a choice but a necessity, Baiduri Bank has taken a bold step forward. The bank has pledged its commitment to sustainable banking and introduced a new brand promise: “Co-creating your future”. This promise is not just a tagline, but a reflection of the ba

What are Promissory Notes, Bills of Exchange, Checks, and Bank Drafts, and What Do They Do?

In the world of finance and commerce, various instruments are used to facilitate transactions and ensure the smooth flow of funds. Among these instruments are promissory notes, bills of exchange, checks, and bank drafts. These financial instruments play a crucial role in enabling individ