China's Strategic Approach to Capital Control

In recent years, China has been implementing strategic measures to address loopholes in its capital controls. The country’s financial authorities have ramped up efforts to curb currency outflows, aiming to alleviate the downward pressure on the yuan, which has been depreciating against the dollar since August 2015.

One of the key measures introduced involves banks in Shanghai being required to balance their currency outflows with equivalent capital inflows. This means that for every sum of renminbi that banks remit overseas, they must import an equivalent amount. In Beijing, the regulations are even more stringent, with banks required to import RMB 100 ($14.60) for every RMB 80 ($11.70) they allow in currency outflows.

These measures were introduced following a curb on capital outflows in November, where authorities significantly restricted the size of outbound investment deals and adjusted the threshold for the vetting of foreign transfers. This move was prompted by concerns that the yuan was entering a depreciative spiral.

Furthermore, Chinese authorities have increased their scrutiny on bitcoin exchanges, conducting spot checks on the country’s three largest bitcoin exchangers. The growing popularity of bitcoin has led to speculation that the digital currency may be used to circumvent capital regulations. These inspections aim to assess potential rule violations and ensure that firms are fully compliant with existing regulations.

Through these strategic measures, China is demonstrating its commitment to maintaining financial stability and ensuring the health of its economy in the face of global economic uncertainties.

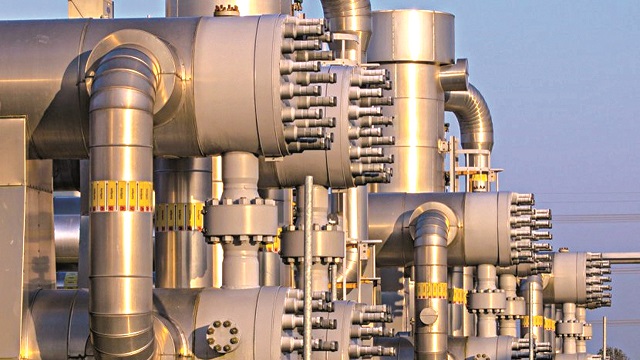

Axxela: Pioneering the Natural Gas Revolution in Nigerian Industries

Axxela, a leading energy company, is spearheading a transformative shift in Nigerian industries through its focus on natural gas. This strategic move aligns with the global trend towards cleaner and more efficient energy sources.Axxela, through its four subsidiaries, supplies natural gas to commerci

The Power of Nigeria’s Young Workforce: A Catalyst for Wealth Creation

TranscriptNigeria’s economy bounced back from its COVID-19 slump with growth of 3.4 percent in 2021. Zenith Bank group managing director Ebenezer Onyeagwu joins World Finance to discuss the country’s ...

Baiduri Bank: Pioneering the Future of Sustainable Banking

In an era where sustainability is no longer a choice but a necessity, Baiduri Bank has taken a bold step forward. The bank has pledged its commitment to sustainable banking and introduced a new brand promise: “Co-creating your future”. This promise is not just a tagline, but a reflection of the ba

What are Promissory Notes, Bills of Exchange, Checks, and Bank Drafts, and What Do They Do?

In the world of finance and commerce, various instruments are used to facilitate transactions and ensure the smooth flow of funds. Among these instruments are promissory notes, bills of exchange, checks, and bank drafts. These financial instruments play a crucial role in enabling individ