What are the misunderstandings of personal investment finance

Personal investment finance is a topic that many individuals find both intriguing and intimidating. While the potential for financial growth and security is appealing, there are several common misunderstandings that can hinder one's ability to effectively manage their investments. In this article, we will explore some of these misconceptions and provide a professional's perspective on how to navigate the world of personal investment finance.

Misunderstanding 1: Investing is only for the wealthy

One of the most prevalent misconceptions about personal investment finance is that it is only for the wealthy. Many individuals believe that investing is reserved for those with substantial amounts of money to spare. However, this belief couldn't be further from the truth. Investing is a tool that can be utilized by individuals of all income levels to grow their wealth over time. Whether you have $100 or $10,000, there are investment options available to suit your financial situation. It's important to understand that investing is not solely reserved for the wealthy, but rather a means for anyone to achieve their financial goals.

Misunderstanding 2: Investing is equivalent to gambling

Another common misunderstanding is that investing is akin to gambling. While both activities involve an element of risk, there are fundamental differences between the two. Gambling relies heavily on chance and luck, whereas investing is based on informed decision-making and analysis. Successful investing requires careful research, diversification, and a long-term perspective. It is not a game of chance but rather a strategic approach to growing one's wealth. By understanding the fundamental principles of investing and making informed decisions, individuals can mitigate risk and increase their chances of financial success.

Misunderstanding 3: Investing is a get-rich-quick scheme

In today's fast-paced society, many individuals are drawn to the allure of quick financial gains. This leads to the misconception that investing is a get-rich-quick scheme. However, successful investing is a long-term endeavor that requires patience and discipline. It is important to understand that investing is not a shortcut to instant wealth but rather a methodical process that yields results over time. By adopting a long-term perspective and setting realistic expectations, individuals can avoid falling into the trap of get-rich-quick schemes and focus on building sustainable wealth.

Misunderstanding 4: Investing is too complex for the average individual

The world of personal investment finance can seem complex and overwhelming to the average individual. With various investment options, financial jargon, and market fluctuations, it's easy to feel intimidated. However, it's crucial to recognize that investing can be learned and understood by anyone willing to put in the effort. There are numerous educational resources available, such as books, online courses, and professional advice, that can help individuals gain a better understanding of investment concepts and strategies. By taking the time to educate oneself and seek guidance from professionals, individuals can navigate the complexities of investing with confidence.

Misunderstanding 5: Investing is a one-size-fits-all approach

Investing is not a one-size-fits-all approach. Each individual has unique financial goals, risk tolerance, and time horizons that should be considered when developing an investment strategy. It's important to recognize that what works for one person may not work for another. A professional's perspective on personal investment finance involves tailoring an investment plan to suit an individual's specific needs and circumstances. By working with a financial advisor or conducting thorough research, individuals can develop a personalized investment strategy that aligns with their goals and preferences.

In conclusion, personal investment finance is a complex yet rewarding field that requires careful consideration and understanding. By debunking common misunderstandings and adopting a professional's perspective, individuals can navigate the world of investing with confidence and increase their chances of financial success. Remember, investing is not solely reserved for the wealthy, nor is it equivalent to gambling or a get-rich-quick scheme. It is a strategic approach to growing wealth over time and can be learned by anyone willing to put in the effort. So take the first step towards financial empowerment and start exploring the world of personal investment finance today.

Personal finance book recommendations

Personal Finance Book RecommendationsAs a professional financial advisor, I am often asked for recommendations on books that can help individuals gain a better understanding of personal finance. It is no secret that managing money effectively is a crucial skill that can greatly impact one'

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

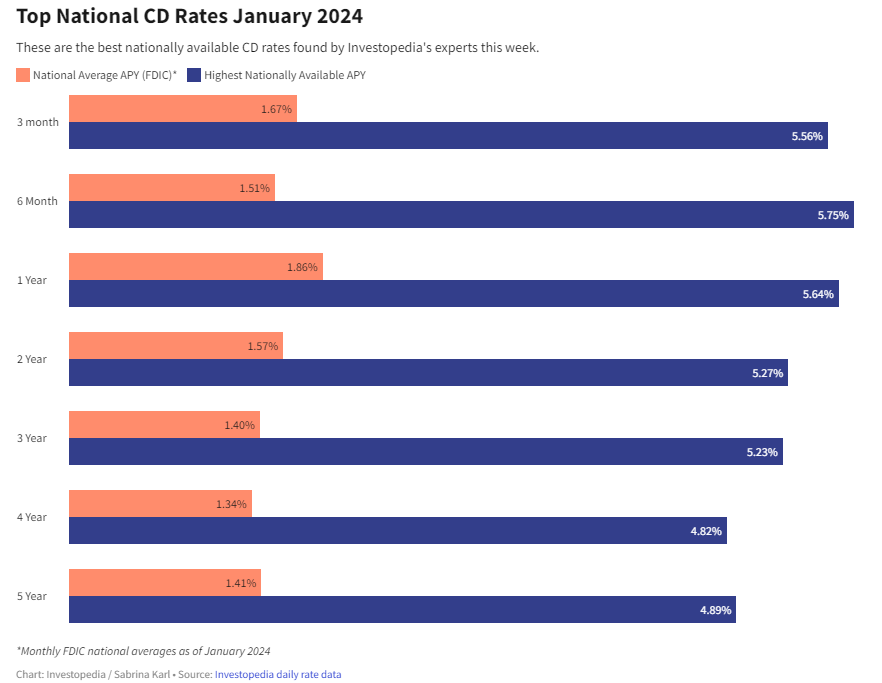

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create