Novice Personal Finance Has These Problems Need to Understand Need to Pay Attention

Personal finance is a subject that everyone needs to understand, regardless of their age, income, or occupation. However, novice personal finance can have some problems that need to be understood and paid attention to. In this article, we will discuss some of the common issues that novice personal finance faces and provide some professional advice on how to overcome them.

1. Lack of Financial Literacy

One of the biggest problems with novice personal finance is a lack of financial literacy. Many people are not familiar with basic financial concepts such as budgeting, saving, investing, and debt management. This lack of knowledge can lead to poor financial decisions, which can have serious consequences in the long run.

To overcome this problem, it is essential to invest time in learning about personal finance. There are many resources available online, such as blogs, podcasts, and YouTube channels, that can help you learn about personal finance. You can also take courses or attend workshops on personal finance to gain a deeper understanding of the subject.

2. Overspending

Another common problem with novice personal finance is overspending. Many people spend more than they earn, which can lead to debt and financial stress. Overspending can be caused by various factors such as peer pressure, advertising, and lack of self-control.

To avoid overspending, it is important to create a budget and stick to it. A budget will help you keep track of your income and expenses and ensure that you are not spending more than you earn. You can also use tools such as apps and spreadsheets to help you manage your finances.

3. Lack of Savings

Novice personal finance often lacks savings. Many people do not save enough money for emergencies, retirement, or other long-term goals. This lack of savings can leave them vulnerable to financial shocks such as job loss, medical emergencies, or unexpected expenses.

To build savings, it is important to make it a priority. You should set aside a portion of your income each month for savings and make it a habit. You can also automate your savings by setting up automatic transfers from your checking account to your savings account.

4. High Levels of Debt

High levels of debt are another problem with novice personal finance. Many people accumulate debt through credit cards, student loans, car loans, and mortgages. High levels of debt can lead to financial stress, lower credit scores, and limited financial opportunities.

To manage debt, it is important to prioritize paying off high-interest debt first. You should also avoid taking on new debt unless it is necessary and manageable. You can also consider debt consolidation or refinancing to lower your interest rates and monthly payments.

In conclusion, novice personal finance faces several problems that need to be understood and paid attention to. By investing time in learning about personal finance, creating a budget, building savings, and managing debt, you can overcome these problems and achieve financial stability and security. Remember that personal finance is a lifelong journey that requires discipline, patience, and perseverance.

How is the interest on bank deposits calculated?

Interest is the amount of money that a bank pays you for keeping your money in a deposit account, such as a savings account, a fixed deposit, or a certificate of deposit. Interest is also the amount of money that you pay to a bank for borrowing money from them, such as a loan or a credit card.

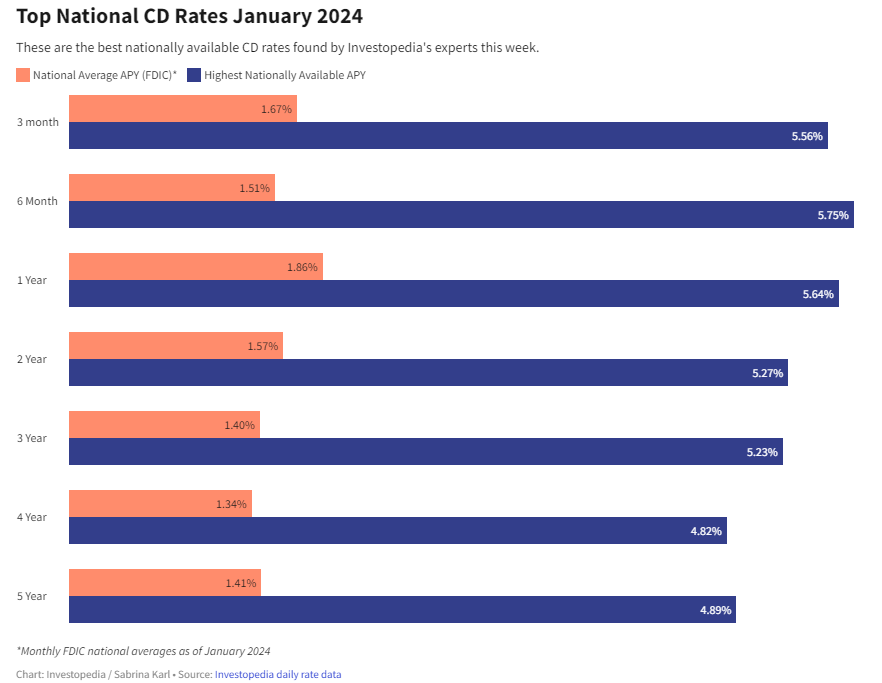

How to Double Your Money with the Best CD Rates for January 2024

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regula

How to buy the right personal financial products

Personal financial products are tools that help you manage your money, save for the future, and achieve your financial goals. They include things like bank accounts, credit cards, loans, insurance, investments, and retirement plans. However, not all personal financial products are create

What is the National Debt?

As a professional in the field of finance and economics, it is essential to have a comprehensive understanding of the national debt. The national debt refers to the total amount of money that a country owes to its creditors, which may include individuals, businesses, and other countries. In this art