Spooky Season: How to overcome money fears

Farnoosh Torabi participates in a CNBC Primetime panel during the Television Critics Association (TCA) Cable Winter Press Tour in Pasadena, California, January 14, 2016. REUTERS/Danny Moloshok/File Photo Acquire Licensing Rights

NEW YORK, Oct 25 (Reuters) - We all have questions about money, but here is one you may not have thought about: What are you afraid of?

The answer could be any number of things. The fear of not earning enough. The fear of getting fired. The fear of making a big investment mistake. The fear of being old, alone and penniless.

“Fear is the emotional underpinning of so many of our money questions,” says Farnoosh Torabi, personal finance expert and author of the new book “A Healthy State of Panic."

The first thing to know about money fears: you are not weird and you are not alone. In fact, 70% of Americans are stressed out about their finances, according to a recent CNBC survey. The biggest fears: inflation, economic instability, rising interest rates and lack of savings.

You do not need to let money fears consume or paralyze you, says Torabi, who hosts the popular "So Money" podcast. Instead, think of fear as your friend: Your brain is just doing what is has been designed to do over hundreds of thousands of years, which is to keep you alive and protect you from potential harm.

Here are a few tips for handling money fears.

DO NOT RUN AWAY FROM IT

When we are confronted with something scary, the natural human response is to flee from it or suppress it and try not to think about it. And how has that been working out for you?

“I used to run away from fear all the time, but then it only compounds and gets bigger,” says Torabi, the daughter of Iranian immigrants who were very protective and highly attuned to the dangers of society. “You can’t just tell it to go away – you have to unpack it."

Of course, fear is very different for each person.

"What I am afraid of is not what you are afraid of," Torabi says. "Fear tells a very personal story about who you are and where you came from.”

GAME PLAN IT OUT

What will you do if the worst happens?

Use that prompt and think it through. If you lose a job – well, perhaps you will get some severance pay, and then look for a new job. If an invoice does not get paid, perhaps you will have to dip into savings for a while, until the money hits your account.

The point is that you probably will not die, and the world will not end, no matter what adversity happens.

“Imagine all the worst-case ‘what-ifs,’ if it happened to you tomorrow,” says Torabi. “In a way, fear is trying to get you to do some homework and prepare.”

OVERRULE YOUR FEARS WHEN APPROPRIATE

Let’s say your childhood was a financial struggle, and your family did not have enough money to get by. Almost undoubtedly those memories are hardwired into you, no matter what your financial situation is like now.

“People with the fear of scarcity don’t ever think they have enough, even if they are making six figures,” says Torabi. “So you have to figure out where that fear came from, and see that fear as an opportunity to go down memory lane.

“Maybe you don’t have to have that fear anymore. You can rewire your narrative, and choose something different.”

USE YOUR FEAR TO GET EDUCATED

Fear is not helpful when it stays in the abstract, Torabi says. General worries about what could happen to the economy or what is going on in the Middle East are just going to keep you in a permanent state of anxiety.

Instead, see fear as an opportunity to learn more about a specific situation. If you are concerned about bank failures, for instance – then learn about FDIC insurance, and which investments are guaranteed and which aren’t.

“If you are scared of the stock market, then study more about stocks – that there are more gains than losses, more bull markets than bears, and that the scarier thing is to not invest at all,” says Torabi.

And if you are still afraid, then do not invest big lump sums, but just a little bit at a time, she adds.

“Sometimes when fear shows up, it just wants you to get educated,” Torabi says.

Reporting by Chris Taylor; Editing by Lauren Young and Jonathan Oatis

Our Standards: The Thomson Reuters Trust Principles.

The 10 richest people in Singapore in 2023

Singapore is home to some of the wealthiest individuals in the world, with a total of 35 billionaires as of 2023, according to Forbes. The city-state’s rich list is dominated by entrepreneurs, investors, and heirs from various sectors, such as technology, real estate, healthcare, manufacturing, and

Top 10 Richest People in Hong Kong - Forbes 2023

Hong Kong, a bustling metropolis known for its vibrant economy and thriving business landscape, is home to some of the world's wealthiest individuals. As we delve into Forbes' latest rankings for 2023, we uncover the top 10 richest people in Hong Kong, who have amassed incredible fortunes th

EFG International Reports Strong Financial Performance and Expansion Plans

ZURICH, Nov 16 (Reuters) - EFG International (EFGN.S) shares surged by 3% in early trading on Thursday following the release of impressive financial results for the first 10 months of the year. The Swiss private bank reported a net profit exceeding 240 million Swiss francs ($270.09 million), showcas

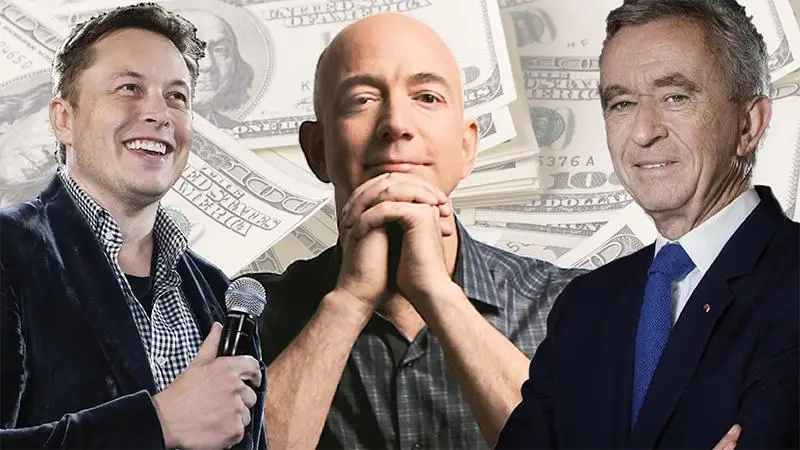

Top 10 Global Richest People in 2023

The 25 richest people in the world in 2023 are worth a collective $2.1 trillion, down a combined $200 billion from $2.3 trillion in 2022 .Here are the top 10 richest people in the world in 2023:1. Bernard Arnault & family: The French luxury goods tycoon tops the World’s Billio